Student debt is killing the American dream

Pew Research Center

Editor’s Note: Samantha Durham is a senior at UNCW studying sociology. She is the Opinion Editor for The Seahawk and enjoys concentrating her work on social issues. All opinions expressed in this article are solely those of the author. Samantha may be found on Twitter @Durham_Sam. All suggestions and inquiries may be sent via email to [email protected].

College is a great place to not only discover your passions but also yourself. I have learned more about myself in college than I have in my whole life. I know what I want, what I can do and certainly what I cannot.

Most of us knew we would end up in college and most of us never thought of another option. The allure of college in American culture only continues to grow with each class of graduating seniors. However, the college path is paved with debt and interest that some people are consumed by, leaving them struggling for years after college to pay it all back and then some.

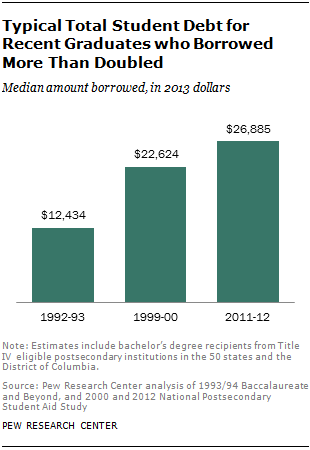

According to the Pew Research Center, as of June 2017 Americans owe $1.2 trillion dollars in student debt. While the amount each student takes out in loans can vary due to many factors, the amount of student debt we have as a country is staggering.

However, with more debt means less wealth as more people have to take the money they earn to pay down their debt instead of using it to invest or save. Overall, a college degree has value otherwise I would not be here. If I did not think the degree was worth the money, I would have decided on another path. With that being said, as more people rack up debt it seems the idea of the American Dream dies with it.

In the United States, it is fairly safe to say that we are individualistic. We pride ourselves on freedom, rights and the ability to pursue our dreams despite all odds. However, those odds seem to keep being stacked against us. Especially those leaving college with oodles of debt. According to the Pew Research Center, the median amount of debt for Bachelor’s degree holders was $25,000 in 2016. This same study also found that those with postgraduate degrees owed a median amount of $45,0000.

My biggest question is how can people truly pursue their dreams when they have to spend years paying off debt? Many might argue that sacrifices have to be made to be successful, but that seems to be even more true for some than others. One Vice documentary showed two teachers, both with Master’s degrees, still living with a parent because they owed too much in student debt to rent or own a home.

Teaching was their dream yet they had to sacrifice other dreams and goals to be able to teach. While the Pew Research Center does point out that student debt can be influenced by degree, it can also be clearly influenced by where you end up after crossing the stage.

If an individual graduates with a degree in finance and lands a great job with a financial firm, making a lot of money, it is fair to say that their debt paid off. They would probably be able to pay off their debt and still have some to save or invest. However, that is obviously not the case for all of us.

According to the Pew Research Center, one in five working adults between 25 to 39 with a Bachelor’s degree and outstanding student debt have more than one job. The same study reports that only 27% of young college graduates with outstanding debt claim to be living comfortably.

For some, the investment in a college education is proving to not be worth the return. With these figures it is fair to say that these graduates are struggling to make ends meet and are probably also struggling to accumulate wealth. How can these graduates be expected to save when they owe more than they can muster?

The American Dream is arguably dying for many due to student debt. Clearly they have goals, dreams and aspirations otherwise they would not be attending college. They have something in mind they want to get out of this experience. Whether that be to make more money, be more marketable or work in their dream field.

However, the debt is robbing them of the opportunity to pursue anything beyond that. While the debt might give them the opportunity to get the dream job, they might be scraping by with it or paying off loans for years to come.

The Pew Research Center also reported that only half of student loan holders think the lifetime financial benefits of their Bachelor’s degree outweighs its cost. That should speak volumes about how much debt people owe and how much they truly earn to pay it back.

I truly see the worth in a college education. It would be hypocritical of me to attend college and see no value in it. However, I am gravely concerned about the amount of money Americans shell out for a college education. For many, it is worth every dime but a balance has to be achieved somewhere.

Just look at countries across the pond, many of them have much more affordable options for college students. While some might still have debt, it is not a crippling amount.

Overall, something needs to be done to solve this dilemma. College should be worth the time and the money. However, if we have to spend years of our lives paying for it, is the degree actually worth the paper it is printed on?

The spirit of the American Dream still thrives. Students all over the country still strive to be doctors, lawyers and educators. However, the American Dream is not just about a career, but a whole life of achievement and success. It is about being able to live the life you aspire for and that anything is possible. Yet with $1.2 trillion dollars in student debt I suppose many dreams will be put on hold.

Kim • Jul 22, 2018 at 4:53 pm

It’s bs to have this kind of debt, people can’t get mortgages, cars, the interest in the loans alone are huge and just compounds the loan. A degree is what a degree use to be anymore. They should allow bankruptcy law again, it’s killing the economy when people are so far into debt that they can’t fulfill their way of living